Sunshine and a sharp ocean breeze this Saturday afternoon on California’s north coast — whipping into the Labor Day weekend and the unofficial end of summer.

Sunshine and a sharp ocean breeze this Saturday afternoon on California’s north coast — whipping into the Labor Day weekend and the unofficial end of summer.

A short-burst of a summer, too.

Rapid and unpredictable, maybe the words, or in the interest of financial markets, ‘volatile,’ and hopefully these aren’t infamous last words: ‘“As China is sneezing, there is very little to suggest that the U.S. is catching a cold,” said Jeremy Zirin, chief U.S. equity strategist for Wealth Management Research at UBS.’

Of course, the guy was referring to the continuing-swinging spectacle of the Chinese stock market this summer, especially with the big drop at the end of August — overall, declining nearly 40 percent in value in less than 80 days.

Wall Street went bonkers for a few hours, but apparently has supposedly overcome the China financial syndrome, but are still involved with the word, ‘volatile,’ as on Friday, the Dow fell nearly 273 points, even with a mixed/still-upbeat August jobs report — a financial shit-on-the-stick future.

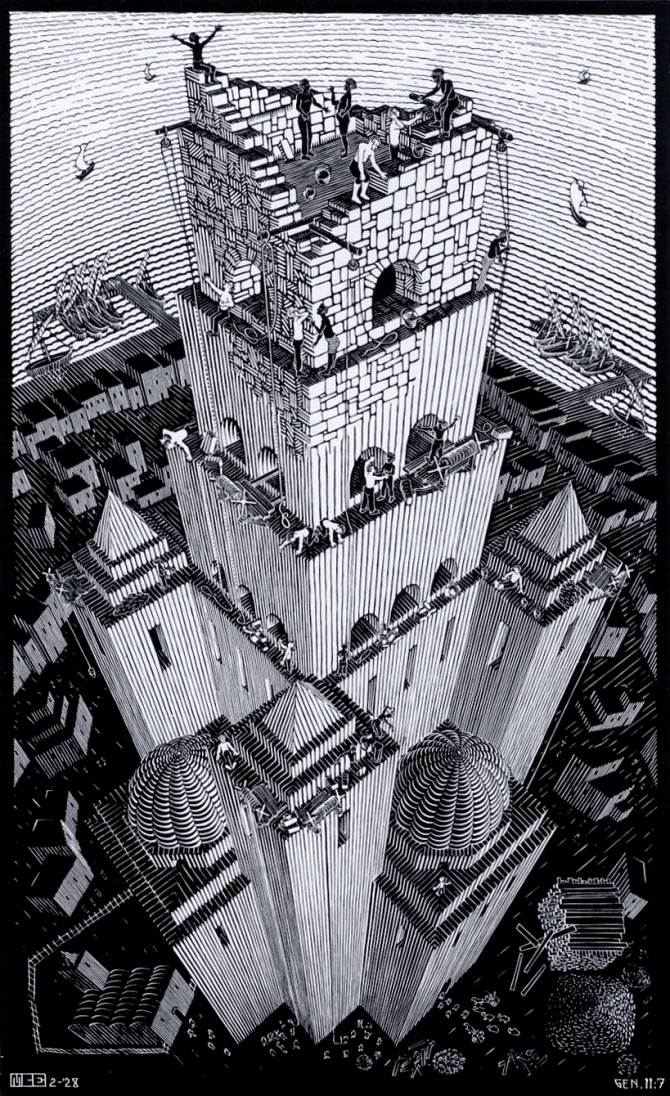

(Illustration: M.C.Escher’s ‘Tower of Babel,’ found here).

Monetary matters for me are sometimes hard to grasp, and in the world of Wall Street, stocks-and-bonds-and-shares are just a stream of words, and creates in my mind, a ‘volatile‘ situation — I simply can’t retain the knowledge. The understanding of something like, ‘derivatives,’ lasts only until the end of the paragraph explaining its function — might be I really don’t want to understand, or maybe I’m just incapable, either way works.

The great financial meltdown of 2008 is comprehensible to me in generalities only, specifics and details would most-likely lead to insanity.

So financial-research sources must be on-the-mark, and written for a simple, though, curious mind. One of the best I’ve come across over the years is Barry Ritholtz at his noteworthy blog, The Big Picture, as he’s usually straightforward about the unfathomable world of Wall Street — so a warning this morning in a call liken to get-your-shit-together, money-wise, or else, made me mentally sit-up straighter — focal point:

Well, folks, “less accommodating, more volatile” arrived last week.

The Standard & Poor’s 500-stock index fell more than 10 percent in four days, something that has happened only nine times in 80 years (since 1934), said Jim Bianco of Bianco Research.

That makes it a rare event of some potential historical significance.

What was true two months ago is even truer today: The sooner you clean up your financial act, the better.

In other words, we’re apparently soon going to travel some bad-motherfucking road. Ritholtz offers ideas like financial planning and portfolio reviews, all toward, and for people involved in the world of finance. He does caution, though: ‘Finally, envision your emotions. If you can imagine the emotional roller coaster the markets may put you through, you can better handle the stress. You cannot control what happens out there in the big old crazy world, but you can manage your response to whatever the market creates. You have been given another golden opportunity to get yourself together.’

And, of course, most of all: ‘Don’t blow it.’

However, the problem might be the whole shebang has already been blown.

In a similar vein, last weekend I came across a piece by noted energy writer Gail Tverberg at OilPrice.com about the troubling concerns within our ‘volatile‘ financial markets, especially in light of the crazy-chaos in the oil industry, with prices dropping faster than a stone, with the combustible results.

Tverberg links finances with debt and the result is catastrophic — she explains:

Back in January, I wrote a post called Oil and the Economy: Where are We Headed in 2015-16?

In it, I said that persistent very low prices could be a sign that we are reaching limits of a finite world.

In fact, the scenario that is playing out matches up with what I expected to happen in my January post.

Among the bottom-line updates of a maybe/could be reality:

— The big thing that is happening is that the world financial system is likely to collapse.

Back in 2008, the world financial system almost collapsed. This time, our chances of avoiding collapse are very slim.— Without the financial system, pretty much nothing else works: the oil extraction system, the electricity delivery system, the pension system, the ability of the stock market to hold its value.

The change we are encountering is similar to losing the operating system on a computer, or unplugging a refrigerator from the wall.— We don’t know how fast things will unravel, but things are likely to be quite different in as short a time as a year.

World financial leaders are likely to “pull out the stops,” trying to keep things together.

A big part of our problem is too much debt.

This is hard to fix, because reducing debt reduces demand and makes commodity prices fall further.

With low prices, production of commodities is likely to fall.

For example, food production using fossil fuel inputs is likely to greatly decline over time, as is oil, gas, and coal production.

And a horrible conclusion:

Some people believe that it is possible for groups of survivalists to continue, given adequate preparation.

This may or may not be true.

The only kind of renewables that we can truly count on for the long term are those used by our forefathers, such as wood, draft animals, and wind-driven boats.

Anyone who decides to use today’s technology, such as solar panels and a pump adapted for use with solar panels, needs to plan for the day when that technology fails.

At that point, hard decisions will need to be made regarding how the group will live without the technology.

We can’t say that no one warned us about the predicament we are facing.

Instead, we chose not to listen.

Public officials gave a further push in this direction, by channeling research funds toward distant theoretically solvable problems, instead of understanding the true nature of what we are up against.

Too many people took what Hubbert said literally, without understanding that what he offered was a best-case scenario, if we could find something equivalent to a perpetual motion machine to help us out of our predicament.

A long, must-read just for the scale of it all, along with ‘historical significance.’