Cold and a bit overcast this Thursday morning on California’ north coast and so far for us on the Pacific beach this current system has spared the worse.

Cold and a bit overcast this Thursday morning on California’ north coast and so far for us on the Pacific beach this current system has spared the worse.

Out east (hah!), a huge storm has hit the fabled US capital with a surge: The storm was dubbed a “snowquester,” a play off the wonky “sequester” term used to describe the $85 billion in cuts from federal budgets over the next six months. While lawmakers were at work inside the halls of Congress, elsewhere the “snowquester” shut down government offices, just as the budget cuts threatened to do.

‘Lawmakers at work‘ — trying to be funny?

Meanwhile, on the brighter side of the rich and infamous — Wall Street ended yesterday with a new high of 14,296.39, the second day in a row for such records, and now the money-for-nothing machine is only 1.3 percent away from its way-top high set in October 2007.

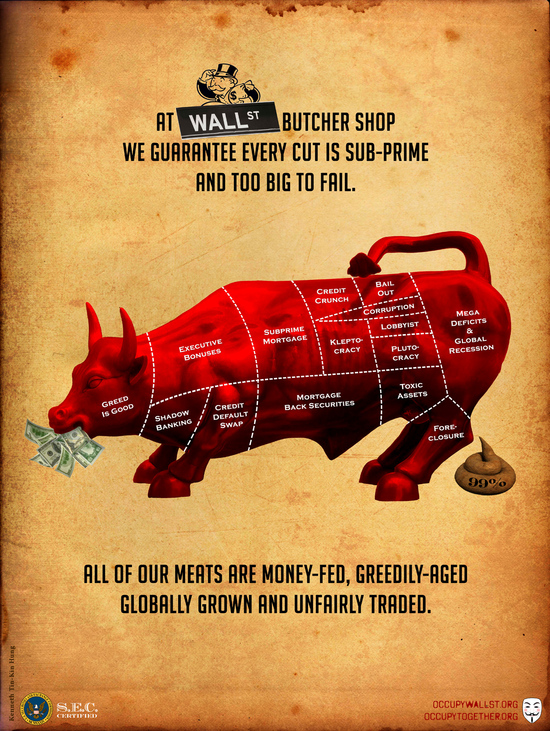

(Illustration found here).

Hurrah, hurrah!

Even as the rest of the country mourns the loss of jobs and income, the Wall Steet bankersters keep piling it on themselves for themselves. They live in a bubble world where nothing is sacred or untouchable. The play with fire, however.

Bill Stone, chief investment strategist for PNC Wealth Management: “There is some concern that it’s precarious because we’ve come so far so fast.”

Who really gives a shit? US AG Eric Holder can’t give a shit because banks are too complicated for the world to handle.

Holder appeared before the Senate Judiciary Committee yesterday and blubbered (via Forbes):

“I am concerned that the size of some of these institutions becomes so large that it does become difficult for us to prosecute them when we are hit with indications that if you do prosecute, if you do bring a criminal charge, it will have a negative impact on the national economy, perhaps even the world economy,†he said.

“And I think that is a function of the fact that some of these institutions have become too large.â€

Forbes, which is fairly conservative and not prone to scream or panic, added this ominous note: That’s a very scary, very ugly way to run the country. Not only are financial institutions operating under the notion of too big to fail but now there’s room for them to behave as negiligently as possible without fear of a criminal case from the federal government.

WTF

Most-nifty Elizabeth Warren popped back:

“It has been almost five years since the financial crisis, but the big banks are still too big fail,” Warren said in a Wednesday statement.

“That means they are subsidized by about $83 billion a year by American taxpayers and are still not being held fully accountable for breaking the law.

Attorney General Holder’s testimony that the biggest banks are too-big-to-jail shows once again that it is past time to end too-big-to-fail.”

Last month, she called out those asshole prosecutors: “There are district attorneys and United States attorneys out there every day squeezing ordinary citizens on sometimes very thin grounds and taking them to trial in order to make an example, as they put it,” she said. “I’m really concerned that ‘too big to fail’ has become ‘too big for trial.'”

Warren is indeed the shinning light on Capital Hill — wish there were more like her.

Heidi Moore in the UK’s Guardian on Tuesday advised caution:

But don’t trust the Dow.

It doesn’t have your best interests at heart.

It lies to you.

It’s that narcissist who’s always preening and trying to look powerful when in fact it barely deserves an invitation to the party.

…

That trickle-down is not happening, and we know it’s not happening.

Companies are sitting on $1.4tn of cash, according to the Federal Reserve.

“That number, a record high, equates to almost 9% of US GDP,” wrote JP Morgan strategist Michael Hood in December.

“The cash stockpile has not risen enormously over the past year but it is roughly double the amount from 10 years earlier.”

Hood explains: it’s not that companies are hoarding money; it’s that they are making so much money there aren’t enough places to spend it. American companies are in a golden age of profitability, even as the unemployment crisis continues and many ordinary Americans find it difficult to either save or borrow money. That hasn’t changed for three years, and there’s no reason to believe it will.

There are other reasons not to get too excited about the Dow.

The most important is that the Dow is not “the market”, no matter what you may read.

The Dow is composed of 30 stocks; they’re not the biggest or most significant 30, so you won’t see Google or Apple or Amazon there.

They’re also picked to give a sickly-sweet picture of health.

The Dow stocks are not representative of both good and bad; when they start to stumble or go through big corporate changes, like Kraft, AIG and Citigroup did, they get kicked out of the index.

And so much for the mirror reality.

Questions for this upside-down fruitcake was found this morning via Susan Milligan at US News and World Report:

A remarkable thing happened while Congress continues to bicker over the budget and

unemployment remains stubbornly high: Wall Street had its best day ever.

The Dow Jones Industrial average hit a record 14,255.77 Tuesday, a positive indicator of where the economy is going.

It was even more stunning that the markets—which purportedly are quite sensitive to factors ranging from policy proposals to political developments—seem unfazed by the fact that Congress can’t get its act together to work on the debt.

In fact, the ongoing dysfunction in Washington

has become its own, sad, stabilizing force in the markets, since the inability to work together has become so depressingly consistent that investors can plan around it.

Markets like certainty and predictability, and Washington lawmakers have certainly provided them with that.

While the news is cheering on paper, it should also raise some deeper questions.

Why is it, four years after Wall Street malfeasance brought the country—indeed the world—to the brink of depression, the investor class is doing so well?

It was galling enough when Wall Streeters who ran the economy into the ground expected to receive huge bonuses as incentives to fix it.

But four years later, they’re back on top, and unemployment is still just below 8 percent?

Big corporations are making record profits, and stocks are at an all-time high.

If these are the “job creators,” where are the jobs?

Part of the employment problem has to do with the expiration of the stimulus so reviled by conservatives.

Many people didn’t like the idea of the government spending more money during a debt crisis, but it was a way to create and keep public sector jobs, priming the pump for an American economy that is 70 percent driven by consumer spending.

Now, it’s the private sector that has the cash. It’s time for them to start investing it in jobs—or explain why they shouldn’t be contributing more to the US Treasury.

I.e., higher tax rates.

The late, great George Carlin figured it out long ago:

Forget the politicians.

They are irrelevant.

The politicians are put there to give you the idea that you have freedom of choice.

You don’t.

You have no choice!

You have OWNERS!

They OWN YOU.

They own everything.

They own all the important land.

They own and control the corporations.

They’ve long since bought, and paid for the Senate, the Congress, the state houses, the city halls, they got the judges in their back pockets and they own all the big media companies, so they control just about all of the news and information you get to hear.

They got you by the balls.

And a last bit of irony — Google’s little artwork this morning is a celebration of the 80th anniversay of the — wait for it — the game of Monopoly.

Ha!